How to Dramatically Increase Your Credit Score Short Term Strategy

By Gavin | July 16, 2019

We're going to figure out how to dramatically increase your credit score in the short term. A lot of people ask about this and we figure recover it, especially since we talked about a lot of different credit cards and how great they are, and you need a good credit score in order to get those great cards.

We are all about how to optimize your credit cards for the short term and long term, basically how to get free travel out of them or how to get cash back out of them.

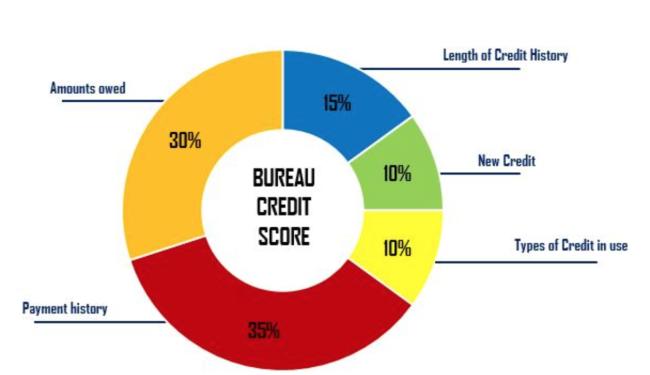

About increase your credit score we just understand what factors drive them, we're going to use a free resource called creditkarma.com, it's a free way to check your credit score, and also the variables that affect it, and also what percentage they are at, how it breaks down.

The factors and how you score in each category

A lot of these other banks, like ms, discover, and even Chase offer free credit scores, but they don't really show you what breaks it down, they kind of tell you what issue might be affecting your scores, that maybe you have too few accounts in the recent history or maybe you have too short of a history for your credit card accounts.

But what credit karma does is it basically tells you all the factors and how you score in each category, the one kind of complaint people have about Credit Karma is that the scores aren't necessarily accurate, so they're approximations. But to me, I think it's a really good way to understand your score which is the most important thing.

The three things that most affect your credit score

The three things that most affect your credit score, our utilization, derogatory marks, and also payment history. Utilization is how much limit you have and then how much of a use, if you have only one card and you use $100 of $1,000, then you have a 10% utilization.

If you have two cards, let's say $1,000 per card, and what one of the cards you have $100, that's a five percent utilization, because it's 100 divided by two thousand four payment history, you're looking at whether you're paying your bills on time or whether you are late with anything.

Derogatory marks or any defaults

Derogatory marks or any defaults, if you have a credit card that you end up not paying off and they end up putting into collections, that would be a derogatory mark, a medium factor would be the average age of your account.

If you have two cards, one at two years old and one at four years old, the average age would be three. Again if you have more cards that are older they kind of build a firm base for your cards, because again if you have five cards that are ten, when you add cards that are now they're going to have less.

In fact, versus if you only had one card that was 10 years old, the two factors are the total number of accounts, and inquiries were a total number of accounts. Most people assumed that the more cards you have the worse you are, and in reality is actually the opposite the more cards you have the better, or most banks see you because they know that you can manage your credit very well and they can manage multiple cards.

Payment history

Again who would you trust? One person who has one card or the person who has maybe two or three, but they're all paid off completely either way. The person who has one card again maybe has a $1,000 limit, the person with two or three cards maybe 20,000 limits and ideas that you can basically manage to finances.

I mean you can make arguments that the more limit you have the riskier you might be, because if you've decided to maximize your credit score and run away then that's a big risk, but again the rational person. Most people wouldn't really cash out like that, so it's not really a risk varying queries.

That's basically how many times you inquire to get a credit card, every time you apply those traits for a credit card they'll do a hard inquiry on your credit report. It shows up on the report now that we have a baseline understanding, the real goal is to find out what factors you can actually optimize.

Dramatically grow your credit score is to focus on utilization

For high impact through our Kotori marks and payment history, those are pretty obvious. If you miss a payment or if you have a derogatory mark they basically are plumbing your credit score. So you need to make sure that doesn't happen.

I'm under the assumption that you are again paying off your cards on time and it's not having any derogatory marks, that's kind of the baseline assumption. I have the way to dramatically grow your credit score from that is to focus on utilization.

Need to stay in excellent range from zero to nine percent

If you're up to nine utilization is excellent, ten to twenty-nine is good, and thirty to forty-nine is fair, if your utilization is between 50 and forty-seven that's poor, and 75% and up is very poor. If you want your credit score to go dramatically you need to stay in an excellent range from the zero to nine percent range.

Again most people are surprised when they do this, four months or two at a seed their credit score grow of 20 or 40 percent, it really depends on the baseline where you're starting from, but otherwise people who have like maybe a low 600 score and they start doing this for one or maybe three-four months.

They see their score go up from a low 600 to either a low 700 or five 600 or maybe even like 720 is the highest, I've seen from that jump, it really is a big factor, if you are someone who carries a bank balance every month, let's say you keep a credit card, you pay off only the minimum, then that's actually really bad, plus they're paying a ton of interest.

Should not carry a balance

So your first school there should be to basically not carry a balance, find a way to somehow fail for credit cards, and again there are different strategies, I might try to cover this in different post, but the idea is that you need to aggressively pay these off as much as you can, because you're paying something like 20% even low-interest ones like 5 or 10%.

It's not really worth it, and the main problem is because there are no other investments you can make, where you're making a risk-free 5% return. Even if you look at something with your bank account or CD from a credit union, you're making maybe 2 to 3 percent at most, and that's still locking up your money for a whole year, and right now you're basically paying 5% over the whole year.

How to optimize utilization

Let's say you pay off your cards in full, great, and then the next step is kind of how to optimize utilization. If you are someone let's say you have a $500 credit limit, and you're using 300 or maybe 400 a bit, that's 60 or 80 percent, and you're kind of falling in the poor and very poor categories.

The main problem here is that you're still paying off your cards enfold, so you don't keep it balanced after the statement, but on your credit report it looks really bad because again they're putting you to the poor category, because they're overusing your limit, but this is kind of a chicken make problem, because you can't apply for all the credit cards that are forced to low unless you apply for like secured cards or really bad cards.

The easiest way is to prepay your cards

There are kind of bad cards money I do them today, but there are cards that don't make sense, so you're in a situation what do you do. The easiest way to do anything about it, it's actually prepaid your cards, let's say your credit card starts on the 1st and the closing date for the statement is the 31st, you don't actually have to wait until the statement closes and pay off your card.

Again let's say on the 15 psi to pay off the whole balance, and that was the 31st rolls around, your utilization will actually be zero, that's really beneficial, because instead of having a very poor grade you're having the excellent grades, and that seems very simple, but by doing this you're increasing your credit score.

It helps to budget a bit better

Another benefit is that it helps to budget a bit better, I still do this myself, I pay off my cards every week, and the ideas that I know how much money is in my bank account, how much of it I spent on going out for groceries or for entertainment or whatever else.

And again if I spent a lot on restaurants this week maybe I cut back next week or the week after that, because I overspent this week for Less my internal budget, and I don't have anything written down specifically, but I think the more you see something the more likely you are to be cognizant and aware of it.

Versus if you only check it once a month then you're like I'm surprised by how much money I spend like I'm never really that surprised compared to other people. I know who wait until the end of the month and then you have a bad surprise there if you're wondering.

Cycling probably doesn't apply to most people

If there are any negative consequences to paying off your cards early not really bad. I guess you're losing out on pre-interest in the sense that you didn't need to pay two weeks early, but you did so, technically you're losing 0.0001 percent of interest you would have made that is probably immaterial.

And the other part is cycling, this probably doesn't apply to most people, but again if you have a very big credit limit, you have a credit limit of ten thousand dollars and you spend that and then you pay it off in two days, and then you spend another ten thousand dollars and you pay it off in two days, and then you keep doing that every few days, then the bank gets worried because you're wondering how you're spending all this money.

It won't really apply to most people, and again like even when I first had a credit card I was maxing on my 500, I pay it off in a week and then I keep doing that. For most people reading this post is a non-issue for the medium impact item, the average age of accounts in the short term, there's nothing you can really do, other than maybe not applying for a credit card.

The new application would dramatically lower your average

Because a new application would dramatically lower your average, depending on how many cards you previously have. If you only have one card right now, let's say it's two years old you apply for a card, it's two plus zero and divided by two, the total number of cards you now have, your average age drops from two to one for the low impact items, the total number of accounts, and total number of inquiries in the last two years.

Basically, just don't apply for cards and you're fine, you can really increase your total number of accounts though without driving down your average age of accounts and the number of inquiries in the long term. Those are obviously different strategies, if you're looking at a big picture it's a bit different but in the short term nothing you can really do here to summarize.

Keep paying off your cards

If you want to dramatically increase your credit score in a short term keep paying off your cards, don't default on any of them and keep your utilization low, even if it means paying off your cards before to date. Again maybe you paid off every week or every two weeks or whatever else, depending on your credit profile.

You might want to hold off on applying for cards for a little bit as well, but otherwise, it's pretty straightforward, I think a lot of people focus on a number of inquiries and they're like don't apply for too many cards. If you want your score to go up which is true, but again utilization really matters, and a lot of people forget about it. I hope this video was helpful.

Other web page resource

Improve Your Credit Score: https://www.myfico.com/credit-education/improve-your-credit-score